Canadians aren't saving enough. A 2014 survey found that one-third of respondents had less than $10,000 in savings. Only 43% of Canadians were saving for retirement. A shocking statistic when you consider that anything can happen at any time, in addition to the unexpected expenses that punctuate our daily lives. Fortunately, you can do something about it by adopting good personal finance habits now and stop wasting money. When working on our personal finances, we often ask ourselves how to avoid wasting money. The best way to start is by taking a look at your daily habits. Here are the ten bad habits of everyday life that make you waste money without realizing it. We'll help you correct them and find new ways to start saving money.

Takeout sounds convenient, but it's disastrous for your wallet and your health. (The relationship between money and health is direct, believe us, you'll see later). When you get takeout, you may feel like you're saving time, but this option is not serving your financial goals. Takeout is very often not so filling because it contains fewer nutrients when compared to home-cooked meals: there are often too many carbs and a lack of vegetables and proteins.

Choose to cook at home. If you don’t have a lot of time, you can also organize yourself to prepare a simple but consistent and balanced meal that will last you all week for your lunches.

Saving money by growing your own food is a great way to teach yourself patience and perseverance while practicing a hobby that keeps your financially stable.

Not exercising is a mistake most of us make. Ignoring your body's well-being and not exercising will cost you money in the long run. Medical bills (with extra fees), illness, inability to work, and even a lower level of efficiency at work are the direct consequences of not taking care of yourself. The best way to avoid facing illnesses and medical bills is to make a sports activity part of your daily wellness routine. No need to go to the gym. You can very well opt for feasible and inexpensive physical practices such as:

- Brisk walking,

- Yoga,

- Jumping rope,

- Cycling,

- Use of home machines such as stationary bikes or treadmills,

- Dancing.

Do not consider that working out is a waste of time. On the contrary, you will be much more productive, and healthier, by integrating physical exercise into your daily routine.

Do you know the perfect expression for wasting money in three words? The impulse buys.

Impulse buys are tempting, especially because they satisfy an occasional craving and soothe our emotions. But they rarely put us on the path to financial independence.

To put off all these purchases and not let your emotions get the better of you, try the 7 Days of Reflection method. Tell the salesman or saleswoman that you will think about it, and don't be fooled by phrases like "only available today." And then give yourself a week to decide if this purchase is necessary or not. You'll see, nine times out of 10, you'll skip that purchase, and you won't even remember it ten days later.

And every time you have the feeling to choose between saving money vs living life, do some exercise to release more endorphins in your body: endorphins can induce a positive and energizing outlook on your life.

How do you stop wasting money? Stop buying coffee to go!

Calculate how much your takeout coffee costs you each day for a whole month. Make your hot beverage at home. You may want to invest in a small thermos to carry the hot drink that you make at home and take on the go. Instead, put this money into your savings account. Think of this account as a money saving box that you never touch. You'll see that this simple habit of saving instead of spending will save you money quickly.

You may wonder “is it worth putting money in a savings account”? Our answer is yes. The earlier you start, the more you'll benefit from compound interest.

Compound interest calculates interest not only on the initial amount of the investment, but also on the interest earned since the initial investment. Interest multiplies exponentially. Here's an example:

- If you invest $500 with 3% interest, you will earn $15 at the end of that first year.

- Leave this money invested at the same interest rate, and the 3% will now apply to this $15, in addition to the $500 initially invested.

- In the third year of investment, the $500 investment is now $546.36.

It is a good start, as it doesn't include the savings you'll be putting aside each month. Let's say you save $10 a month and put it in this account: after ten years, you'll have $2,066.44.

And you'll only have to save $10 a month: a minimal effort daily. Start saving as soon as possible, even in small amounts, to ensure a steady return from your compound interest.

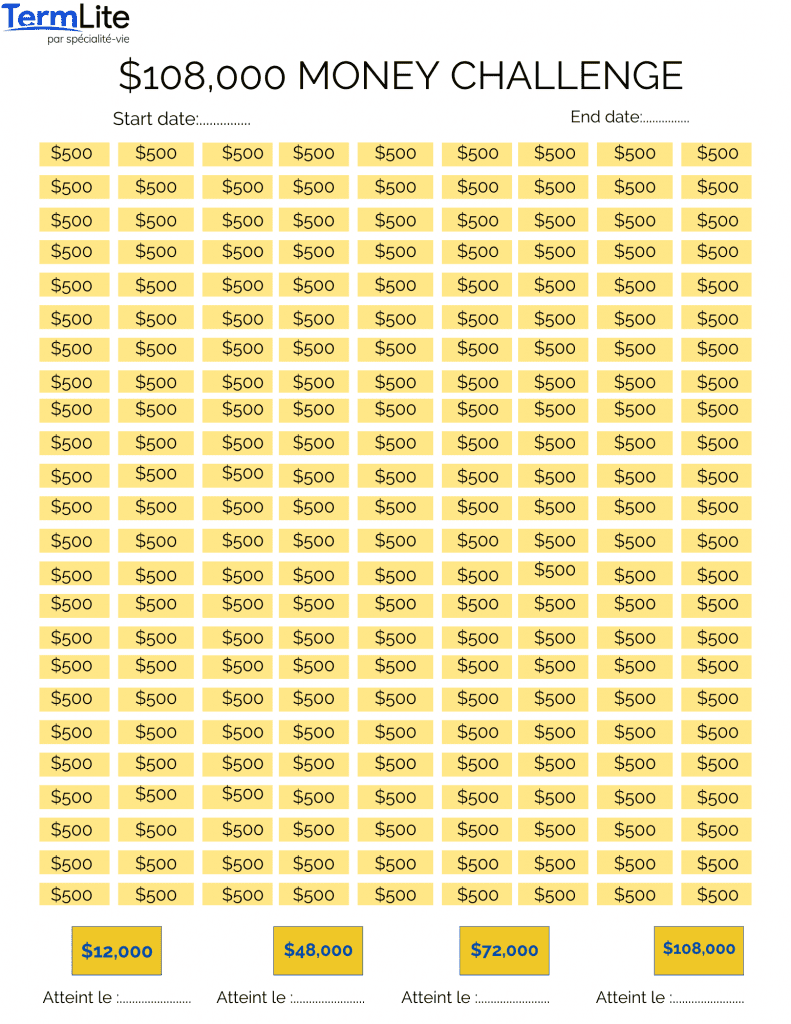

To help you achieve your financial goals, we have created a money saving chart. Fill the dates and check a box every time you save $500. And don’t forget to give yourself a pat on the shoulder to reward you when you succeeded to reach a step!

You may not think about it now, but consider that you may want to sell your home in a few years. If you aren’t taking care of your home now, you could harm your chance at selling it in the future. Take care of your home, as this space that needs to be maintained. Be pragmatic and make sure you avoid any damage that can cost you a lot more after months of neglect. You don’t always have to turn to professional services for your home’s repairs. If you feel comfortable enough with a project, try and do it yourself and save a bit of money.

The cost of living is increasing, and so are the prices of "pleasures": the cost of a pack of cigarettes increases every year for a product that brings you (let’s face it) absolutely nothing. The same goes for alcohol, which like cigarettes, represents a lot of spending and causes health problems.

If you have a problem of addiction, some methods to stop smoking, such as hypnotherapy or acupuncture, may help you and may be reimbursed by your employer's health insurance.

One of the worst financial mistakes you can make is to increase your expenses when your income increases. Just because you can afford something doesn't mean you should buy it.

On the contrary, when your income increases, think about how you could decrease your expenses to save even more. By balancing out your savings to match your higher income, you’ll give yourself more opportunities to reach important goals like getting the home you always wanted, or starting your own business.

When you're about to spend your money on something, here's another question to help you avoid wasting money: "What could cost me less?"

- What costs less than public transportation? A bike.

- What is cheaper than buying new clothes? Second-hand clothes.

- What is cheaper than a new cell phone? A second-hand unlocked phone.

- What is cheaper than buying a drill? Borrowing it from someone!

For every purchase that seems necessary, ask yourself: "What else can I do? Can I find it cheaper? Can I rent it? Who could lend it to me?” You could find very affordable solutions for each thing you though at first you would have to buy.

When shopping for food, be specific and choose with awareness. There are two methods when it comes to groceries:

- People who plan their meals for the week and shop accordingly,

- Or people who run small errands daily,

- People who know their food habits and shop online.

This is the best way to avoid throwing away food and wasting money. Find a method that works for you, and stick with it.

Thinking about the future is also involves looking into life insurance coverage. If you have large debts such as a mortgage, consider that a financial product as simple as term life insurance can provide your family with financial security in the event of a problem. Thinking ahead also means thinking about all the situations that could arise.

We understand that temptations are everywhere, and living life is easier than sticking to the constant effort of saving money. Here are our final tips for balancing your finances:

Pay attention to your credit score, and pay off your credit card debt on time each month. You will thus avoid paying interest, and a good credit score will help with milestones like purchasing a home or new car. If you have debt, focus on paying it off as quickly as possible. A quick money loan to pay off your debt is never a good idea: you're just moving your debt, sometimes to an institution that will likely cost you more.

As a conclusion

Now is the time to make some positive changes over the next few weeks. You will look back on your finances in a few months with satisfaction and give yourself peace of mind knowing that you are working towards your financial goals.

What a great feeling, isn't it?

Once you have established your new savings lifestyle, the next step is protecting your family’s financial future. The best way to save on life insurance coverage is to get it now rather than later. Term life insurance is a simple and affordable tool that guarantees the financial well-being of your loved ones.

And if you're wondering, can you waste money with life insurance? Yes, if you don't have the right coverage. That's why our licensed advisors can explain the benefits of term life insurance and help you determine the right life insurance plan you need. To receive more information, please complete the free quote request form.

Written by Diane Taes