The whole idea of going to college and deciding what career to pursue is very exciting. After all, it symbolizes a unique opportunity to determine who we are and what we wish to accomplish in life. Further than that, going to college also allows us to meet new people, expand our horizons, network, and learn about matters that genuinely interest us.

Considering all these benefits, there is no wonder why so many believe that studying is the best period of a person’s life.

However, going to college also represents a big challenge for many Canadian families and students, as it isn’t cheap. While studying in Canada is more affordable than our neighbouring country, the truth is that you will still need between $20,000 and $30,000 annually to cover tuition and other related expenses.

Surprised? Let's dig a little further into that...

In Canada, universities set their own fees, and these vary depending on several factors, such as the type of program you are studying and location. Studying at the University of Toronto, for example, is considerably more expensive than studying at the Memorial University of Newfoundland, especially if you also consider housing and transportation.

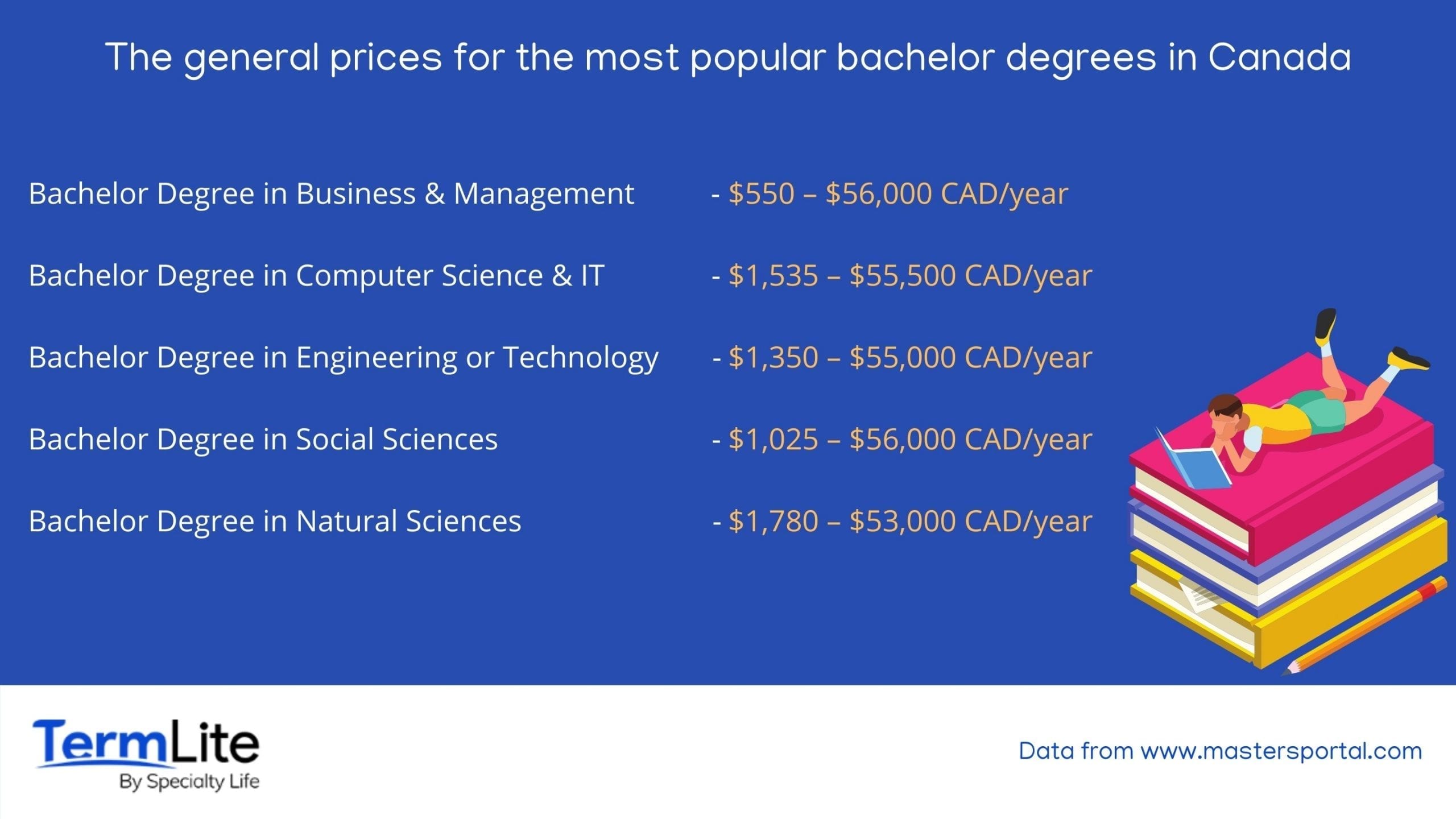

At large, according to TopUniversities, Canadian students can expect to “pay an average of CA$6,463 per year for an undergraduate degree, and CA$7,056 per year for a graduate degree.” Just so you have an idea, these are the general prices for the most popular bachelor degrees in Canada, according to MastersPortal:

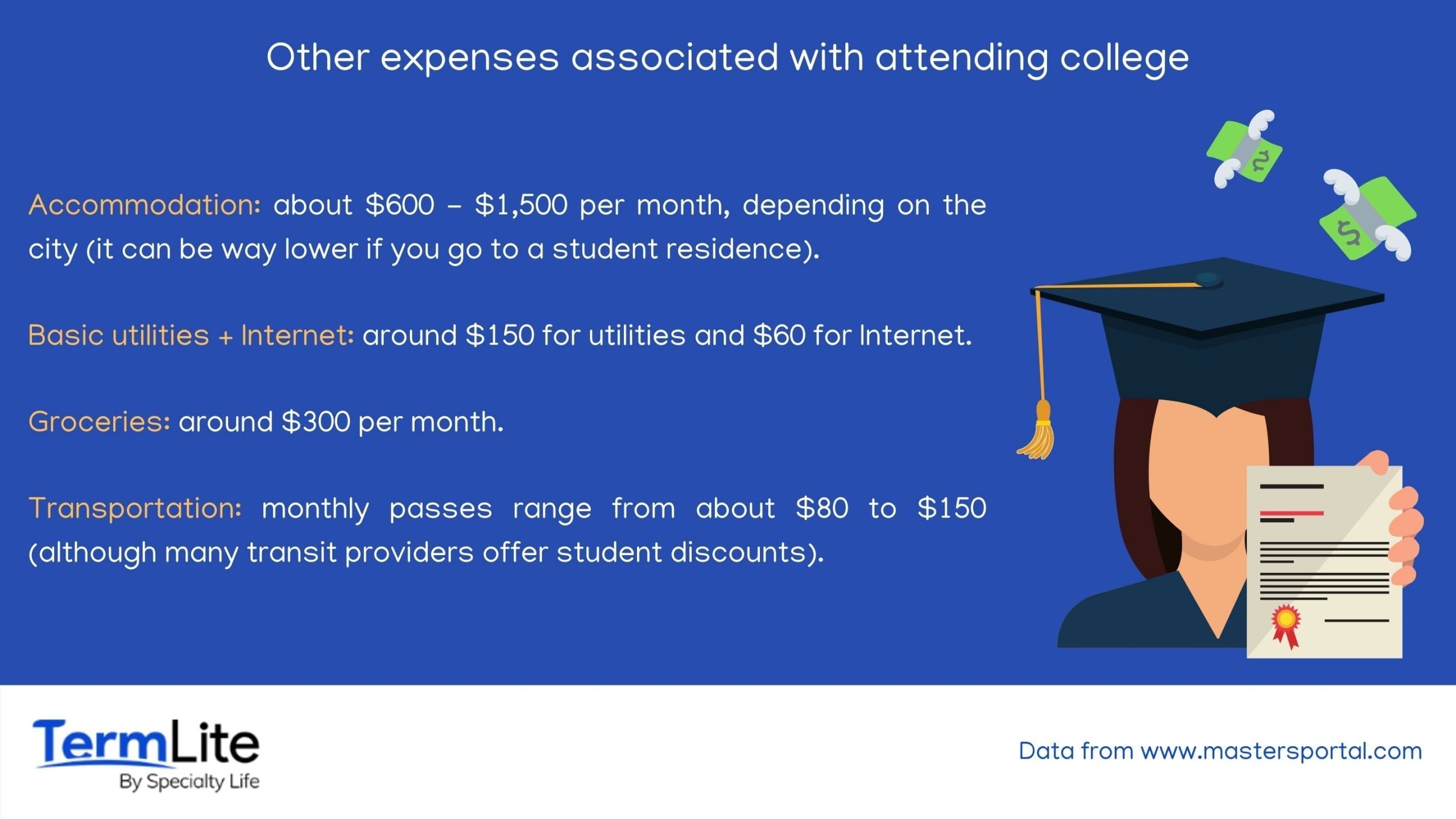

Besides paying for college and textbooks, students also have to support their lifestyle. That means finding proper accommodation (which can add up a lot to the final price in cities like Toronto or Vancouver), essential utilities, internet, and money for groceries and other expenses like traveling and extracurricular activities. These numbers from MastersPortal will help you have a clearer idea of the general expenses:

Summing up all these expenses, it is understandable that people wonder whether higher education is still a profitable investment, especially when you think of the loans and debt involved.

The answer is clear. Despite the rising cost of education in Canada (and worldwide), the financial effort of getting a college degree remains a solid and profitable investment for most people. Even with the increasing opportunities and wages for workers holding only a high school diploma, investing in higher education remains financially worth it for all sorts of reasons.

Having a degree allows you to access better job opportunities and higher salaries after graduation. According to a study conducted by Statistics Canada, "over the course of 40 years, a college graduate will earn $394,000 more than a high school graduate." For a bachelor's degree holder, the number can get as high as $745,800 over the course of 40 years.

But having a degree goes beyond securing a good job and a steady income. Bachelor's degree holders are 47 percent more likely to have health insurance provided through their job and even a longer life expectancy. According to a study conducted by Lumina Foundation, those who have attended college can expect to "live seven years longer than their peers with no postsecondary education." That's a good enough reason to invest in higher education, don't you agree?

Students don't usually see themselves as someone who needs life insurance, and that is entirely understandable. After all, when you are 18 years old, healthy, and free of commitments, purchasing an insurance policy doesn't even come to mind. At least not as much as Spring Break.

But here is something worth thinking about: what would happen to your potential student loans or debts if something unexpected happens to you? Here is the most likely scenario: they would become your family's responsibility.

Considering that Canada's average student loan debt is about $17,741, this could suggest significant financial stress for your loved ones. On top of that, if you have auto loans, credit card debt, mortgage debt, or any other sort of debt, the whole situation could even lead to your family's bankruptcy.

As you can see, having a life insurance policy can become quite handy. Life is unpredictable, even for the young and healthy, which is why it is always a good idea to have a proper type of protection in place for the people you care about the most.

Besides loan debt, getting married, or having a child are other good reasons to buy life insurance. Even if you are not planning on starting a family soon, the truth is that once you graduate, the likelihood of this happening begins to increase. As Statistics Canada concluded, Canadians get married when they are around 27 years old, which is about 4 to 5 years after graduation. So even if you are single and childless now, there is a big chance that your reality shifts in less than a decade.

If you get insured now, you will be investing in your future family’s protection. Being ready now means you won’t have to worry tomorrow, especially about higher premiums. That’s right: the benefit of getting a life policy now is that the younger you are when you get a plan, the lower your premiums will be.

Although you may assume you can’t afford life insurance because you are young and financially unstable, youth is the ideal time to buy life insurance. Here is why: age is one of the primary factors insurance companies consider before insuring someone. The fact that you are young means you are less risky, hence, cost less to insure.

Another factor that is as valuable as age in determining an applicant’s life insurance risk is health. By being young, you are also likely to be healthy and free of pre-existing conditions, such as diabetes or high blood pressure. Statistically speaking, having excellent health status means you are less prone to see an early death - and, therefore, safer to insure.

Finally, if you opt for a term life insurance policy (which usually covers a period between 10 and 30 years), you can enjoy even lower premiums. That is because term life insurance is, in most cases, a simpler and more affordable product. Unlike whole life insurance, term life plans have no savings elements attached to the coverage. It provides pure insurance protection, having no purpose other than to pay a benefit to the chosen beneficiary if the necessity arises.

By being so straightforward and affordable, it is easy to understand why it is the most popular type of life insurance amongst younger people - including college students.

Here is the truth: most young people do not need whole, universal, or permanent life insurance. But, like we already explained, they still need to have protection in place, especially if dependents are involved.

If you are a college student or new graduate, term life insurance is the most recommended product for you. Thanks to its flexibility, simplicity, and customization capability, this product is the best option for those looking for reliable and affordable protection.

If you are a college student who has dependents, it is even more essential to take out a life insurance policy, regardless of your health status. Like we already mentioned, life can change in the blink of an eye. Keeping the people you care about financially protected should be a top priority, especially if you have private student loans or outstanding debts.

At TermLite, we want to help people like you find the perfect life insurance product. That is why we developed a customizable term life insurance plan that doesn’t require medical exams to apply. It truly is simple, quick, and affordable - the way college students like!

If you wish to receive a free quote, you just need to complete a quick form and talk with one of our friendly advisors. By understanding your circumstances and financial situation, they will suggest to you the best options and rates.